Maisons de ville et condos à vendre à Dorval

Le Quatrième offre une mixité résidentielle où maisons de ville, maisons unifamiliales, lofts et condos se côtoient. Dans la même lignée que les projets à succès Espace MV1, MV2 et MV3, Le Quatrième promet une expérience d’habitation de qualité supérieure au cœur d’un site courtisé. Bordé de vastes espaces dégagés et adossé à un secteur résidentiel, ce quartier d’habitations situé à l’ouest de Montréal et offrant des maisons de villes spacieuses, est à la portée des professionnels désireux de s’épanouir au sein d’un environnement respectueux de la nature et où s’éveille un profond sentiment d’appartenance; ils y découvriront un style de vie qui leur ressemble.

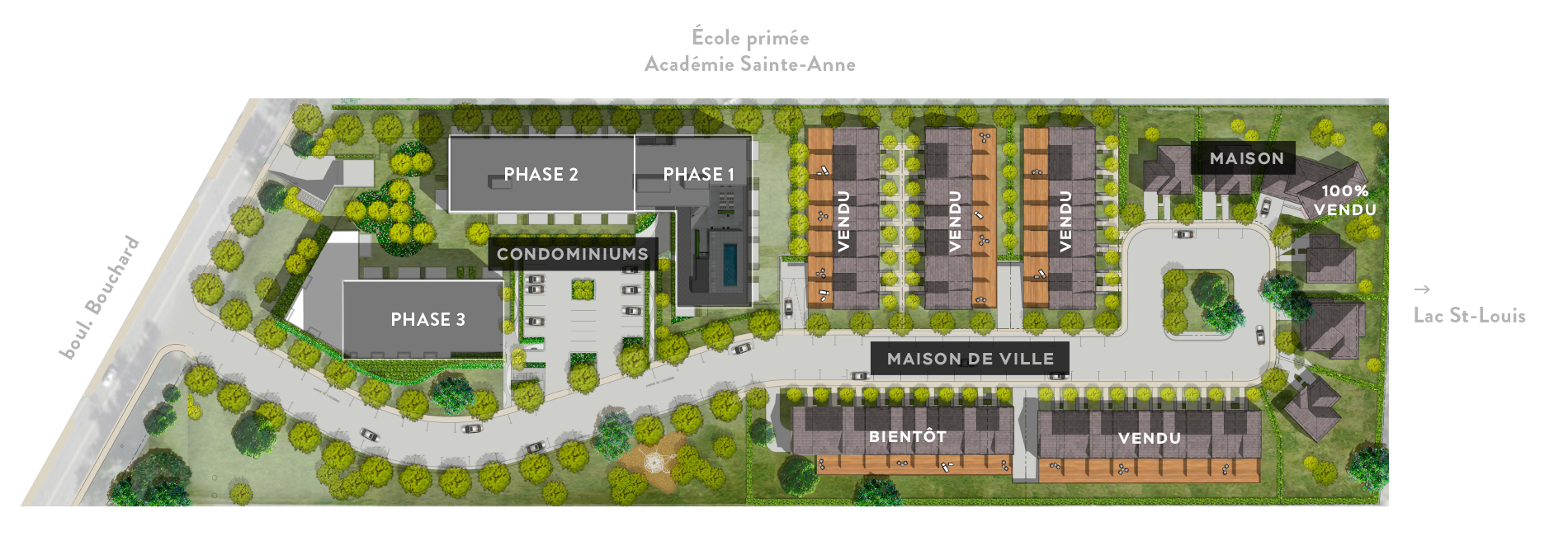

Logé sur le boulevard Bouchard à Dorval et avoisinant l’Académie Sainte-Anne, Le Quatrième se trouve à deux pas des commodités et des services urbains les plus recherchés. Écoles primaires et secondaires, parcs publics et pistes cyclables, services municipaux, commerciaux et de transport en commun se trouvent à proximité.

Découvrez ce nouveau projet de maisons de ville à Dorval

Le projet comprend également 39 maisons de ville en copropriété offrant un milieu confortable où l’ambiance chaleureuse rassemble toute la famille.

Ces espaces de vie personnalisés profitent d’une fenestration généreuse laissant pénétrer la lumière naturelle. Spacieuses, les maisons de ville comptent trois chambres à coucher, deux salles de bain ainsi qu’une grande terrasse et un garage double. Une mezzanine est également offerte en option. Les maisons de ville du projet Le Quatrième, situé dans l’ouest de Montréal ont vraiment tout pour plaire.

ESPACE CLUB

Lieu rassembleur unique en son genre, l’Espace Club insuffle au projet Le Quatrième un esprit de communauté au cœur d’un village urbain. Cet espace tout neuf, réservé aux occupants du Quatrième, comprendra un salon de détente, un centre d’entraînement et une piscine extérieure nichés tout en haut d’un bâtiment de six étages d’où ils pourront savourer la vue exceptionnelle sur le lac Saint-Louis.

Endroit par excellence pour goûter au bien-être que procure Le Quatrième, l’Espace Club est un véritable havre de paix à deux pas des habitations du projet.

Un quartier , une communauté

Située à seulement 15 minutes du centre-ville de Montréal, Dorval vit au rythme de ses environnements à caractère urbain. L’abondance d’espaces verts et sa proximité de la rive du lac Saint-Louis, promesses d’une qualité de vie propice aux activités de plein air savent charmer le cœur des personnes à la recherche d’un milieu de vie paisible. Les Dorvalois tirent plaisir d’une multitude d’activités et d’installations récréatives, culturelles et communautaires. Parmi celles-ci, on retrouve :

- Piste cyclable

- Espaces verts

- Promenade riveraine

- Port de plaisance

- École de voile et kayak

- Club de yacht

- Golf

- Soccer et hockey

- Garderie Écoles primaires et secondaires

- Collèges publics et privés

- Bibliothèque

- Terrasses et boutiques

- Marché public

- Autoroutes 13 et 20 Autobus 195

- Complexe sportif, aréna et piscines

- Centre commercial

- Les Jardins

- Dorval Gare de train (train de banlieue et VIA Rail)

- Aéroport international Montréal-Trudeau

- Métrobus 173 et 211